Surfacing fresh content for discovery

SUPPORTING NEW CONTENT CREATORS (HYPOTHETICAL RESEARCH PROPOSAL)

SHOW NEWLY MINTED CREATORS TO CONSUMERS - AT THE RIGHT TIME

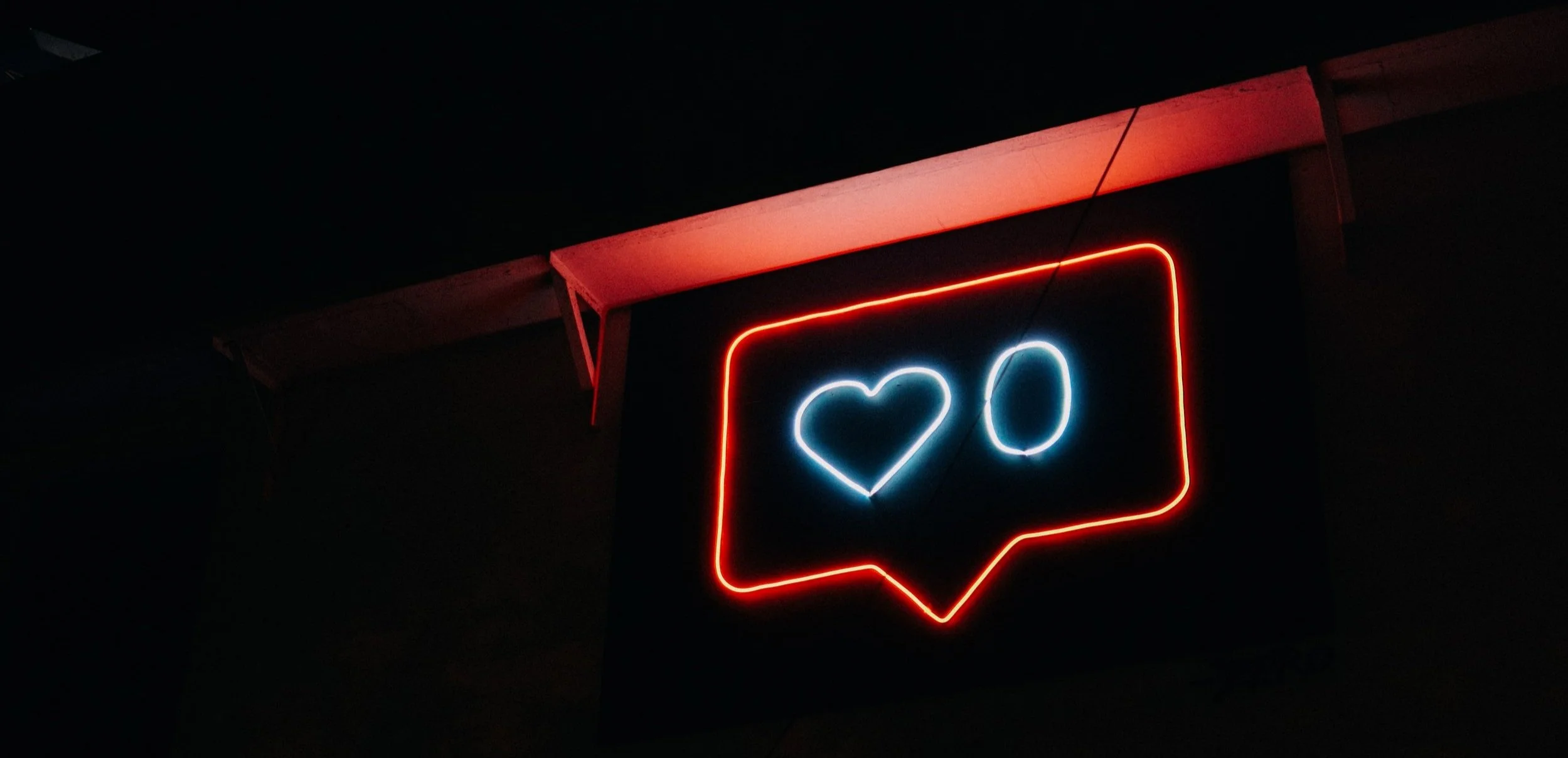

The social video content creation platform, AcmeGram, has grown to a stage where only a small percentage of content creators are successful on the platform. This is a problem because success is measured by the number of consumers viewing or engaging with a user’s created content. This research will learn more about this issue and will provide the product and design teams with recommendations and solutions.

RESEARCH OBJECTIVES

Understand why only a small percentage of content creators are enjoying successful view counts and engagement from consumers.

Provide insights and UX recommendations to the product development team.

SUCCESSFUL VS UNDISCOVERED

For the purposes of this research study, we will define the benchmark for “successful” vs. “undiscovered” content creators as a per video average of 5,000 views and 500 engagements (likes, shares, saves, or reposts).

HYPOTHESIS

Content from “undiscovered” creators is of high quality, but not easily created and/or not surfaced at the right time or way.

METHODS

ALGORITHM REVIEW (1-2 DAYS)

Understand from development team how content is weighted and what is prioritized in user’s feeds – how and when do “undiscovered” content creators appear?

Document and be aware of current state rationale.

Identify gaps in the weighting and/or algorithm.

UX REVIEW

Document existing entry points to “undiscovered” content.

USER OBSERVATION

Recruit 3 newly registered and 3 veteran consumer users, each for a 1 hour recorded session via virtual screenshare, and observe them naturally interacting with their feed and engaging with others’ content. Welcome development and marketing teams to participate if there is interest.

Create informed consent and script. I’ve included a ‘lite’ sampling of potential prompts below.

Observe how and when consumers interact with content, prompting to “think out loud” when necessary.

When consumers skip an “undiscovered” content creator’s post:

Note where in the app they are when they skip

Ask if they saw the post (Nicely – e.g. I noticed you scrolled past a post by @undiscovered, did you happen to see it?)

Ask why they scrolled past

Ask them to view the post

Is this type of content the type of content you’d like to view?

When would be the best time to view this type of content?

When consumers view but don’t engage with an “undiscovered” content creator’s post:

Ask why they didn’t engage

Ask what factors cause them to engage

When they view and engage with a “successful” content creator’s post:

Ask why they viewed and what prompted them to engage

Immediately after each session, note top takeaways. As the sessions are progressing, determine if themes are emerging or if more participant sessions would be of benefit.

USER INTERVIEWS

Recruit 5 “undiscovered” content creators each for a 1 hour recorded video session.

Create informed consent and script. I’ve included a ‘lite’ sampling of potential prompts below.

Ask participants to create and edit a 10 - 20 second video introducing themselves.

Discuss:

Pain points within the app for content creation and collect SEQ.

Why they believe they are not receiving successful view counts or engagement.

What interventions might help them meet what the algorithm tends to boost (e.g. consistency, etc.).

Document current state NPS and CSAT.

COMPETITIVE AUDIT

Document how other platforms within and outside of the industry promote new content, authors, products, hosts, artists, etc.

ANALYSIS

After all user observation sessions are complete, review notes, develop themes, key user stories and use cases.

Cross-reference collected quantitative data (NPS and CSAT) against industry average.

DELIVERABLE

A presentation and deck with:

Key insights

Quick overview of current state and its rationale

Representative consumer quotes, video clips, and user stories that support key insights

Screenshots of best in class solutions across industries

Illustrations and bulletpoints of potential solutions to trial

Next steps:

Trial prototype solutions with user testing, to narrow down to a few final product recommendations in time for the product and design teams to have resources to kick off implementation.

Since we’re talking unlimited budget and resources, it would be ideal to design and develop the top few solutions and release as an A/B test on Production for a short period before settling on the one that results in the largest increase in view counts and engagement for previously “undiscovered” content creators.

After the full public rollout of the solution, recruit 5 more new content creators and perform the same user interviews to compare new SEQ, NPS, and CSAT scores.